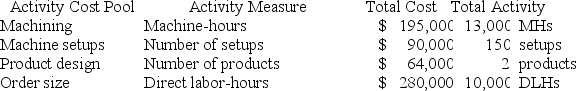

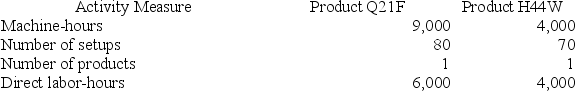

Hails Corporation manufactures two products: Product Q21F and Product H44W. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Q21F and H44W.

Using the ABC system, the percentage of the total overhead cost that is assigned to Product Q21F is closest to:

Using the ABC system, the percentage of the total overhead cost that is assigned to Product Q21F is closest to:

Definitions:

FIFO Method

"First In, First Out," an inventory valuation method where the oldest inventory items are recorded as sold first.

Weighted Average Method

A computation that considers the different levels of significance of the numbers within a dataset.

Work in Progress

Inventory representing partially completed goods which require further work before they are ready for sale.

Equivalent Units

A metric used in cost accounting to express the work done on partially finished goods as an equivalent number of fully completed units.

Q1: Oriental Corporation has gathered the following data

Q22: Bachrodt Corporation uses activity-based costing to compute

Q27: Joetz Corporation has gathered the following data

Q28: Boudoin Corporation manufactures two products: Product T72T

Q32: Cambra Corporation manufactures two products: Product N70E

Q80: Figge & Mathews PLC, a consulting firm,

Q81: The following data pertain to an investment

Q103: Elbrege Corporation manufactures a single product. The

Q136: Almendarez Corporation is considering the purchase of

Q187: Smidt Corporation has provided the following data