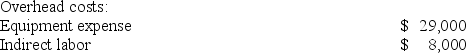

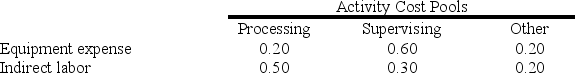

Bartow Corporation uses an activity based costing system to assign overhead costs to products. In the first stage, two overhead costs--equipment expense and indirect labor--are allocated to the three activity cost pools--Processing, Supervising, and Other--based on resource consumption. Data to perform these allocations appear below:  Distribution of Resource Consumption Across Activity Cost Pools:

Distribution of Resource Consumption Across Activity Cost Pools: In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

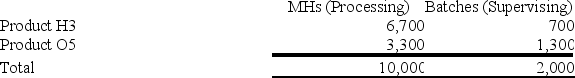

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

Activity: What is the overhead cost assigned to Product H3 under activity-based costing?

What is the overhead cost assigned to Product H3 under activity-based costing?

Definitions:

Q35: (Ignore income taxes in this problem.) Bradley

Q47: Uchimura Corporation has two divisions: the AFE

Q53: Moskowitz Corporation has provided the following data

Q68: McCoy Corporation manufactures a computer monitor. Shown

Q84: Tustin Corporation has provided the following data

Q90: Ciulla Corporation manufactures two products: Product J12N

Q93: Kretlow Corporation has provided the following data

Q104: Diehl Corporation uses an activity-based costing system

Q113: Hayworth Corporation has just segmented last year's

Q251: Azuki Corporation operates in two sales territories,