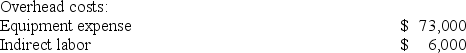

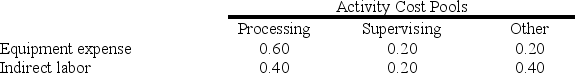

Deemer Corporation has an activity-based costing system with three activity cost pools--Processing, Supervising, and Other. In the first stage allocations, costs in the two overhead accounts, equipment expense and indirect labor, are allocated to the three activity cost pools based on resource consumption. Data used in the first stage allocations follow:  Distribution of Resource Consumption Across Activity Cost Pools:

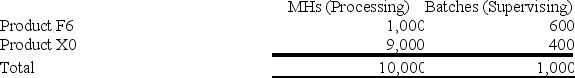

Distribution of Resource Consumption Across Activity Cost Pools: Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

Activity: How much overhead cost is allocated to the Supervising activity cost pool under activity-based costing?

How much overhead cost is allocated to the Supervising activity cost pool under activity-based costing?

Definitions:

Ending Inventory

The total value of a company's merchandise, raw materials, and finished and unfinished products which have not yet been sold at the end of an accounting period.

Purchases

The act of buying goods and services, typically for the purpose of resale in the ordinary course of business.

Consignee

A person or company to whom goods are shipped for sale, who receives and sells the goods on behalf of the consignor.

Consignor

The consignor is the party that owns goods or merchandise and entrusts them to another party, known as the consignee, for the purpose of sale.

Q5: The management of Opray Corporation is considering

Q35: Spiess Corporation has two major business segments--Apparel

Q39: A complete income statement need not be

Q40: Ing Corporation, which has only one product,

Q100: Mayeux Corporation uses an activity-based costing system

Q115: Cranston Corporation makes four products in a

Q144: Feldpausch Corporation has provided the following data

Q205: Ben Corporation manufactures two products: Product E05G

Q219: Sherwood Corporation has provided the following data

Q239: Job-order costing systems often use allocation bases