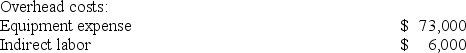

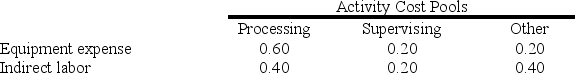

Deemer Corporation has an activity-based costing system with three activity cost pools--Processing, Supervising, and Other. In the first stage allocations, costs in the two overhead accounts, equipment expense and indirect labor, are allocated to the three activity cost pools based on resource consumption. Data used in the first stage allocations follow:  Distribution of Resource Consumption Across Activity Cost Pools:

Distribution of Resource Consumption Across Activity Cost Pools: Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

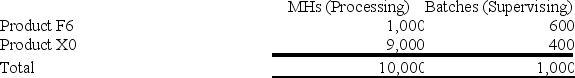

Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

Activity: The activity rate for the Supervising activity cost pool under activity-based costing is closest to:

The activity rate for the Supervising activity cost pool under activity-based costing is closest to:

Definitions:

Subsidies

Subsidies are financial grants or support extended by governments to firms, individuals, or institutions to encourage the production or consumption of certain goods or services, or to support industries.

Domestic Firms

Refers to companies that operate within the country where they are based and conduct their business activities in the local market.

Subsidies

Financial contributions by a government or public body to support businesses, consumers, or economic sectors, reducing the price of goods and services or the cost of production.

Economic Integration

Occurs when two or more nations join to form a free-trade zone.

Q3: When unit sales are constant, but the

Q40: The required rate of return is the

Q79: Generally speaking, net operating income under variable

Q98: Bryans Corporation has provided the following data

Q120: In absorption costing, nonmanufacturing costs are assigned

Q152: The most recent monthly income statement for

Q177: (Ignore income taxes in this problem.) Ostermeyer

Q180: Fusaro Corporation uses a predetermined overhead rate

Q255: Carriveau Corporation has two divisions: Consumer Division

Q256: Carradine Corporation uses a job-order costing system