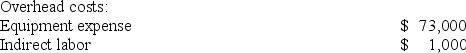

Addleman Corporation has an activity-based costing system with three activity cost pools--Processing, Supervising, and Other. In the first stage allocations, costs in the two overhead accounts, equipment expense and indirect labor, are allocated to the three activity cost pools based on resource consumption. Data used in the first stage allocations follow:  Distribution of Resource Consumption Across Activity Cost Pools:

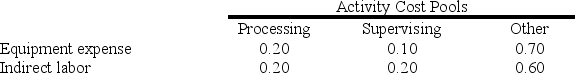

Distribution of Resource Consumption Across Activity Cost Pools: Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

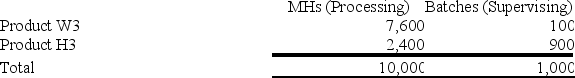

Activity: Finally, the costs of Processing and Supervising are combined with the following sales and direct cost data to determine product margins.

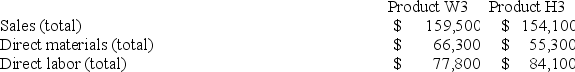

Finally, the costs of Processing and Supervising are combined with the following sales and direct cost data to determine product margins.

Sales and Direct Cost Data: What is the product margin for Product H3 under activity-based costing?

What is the product margin for Product H3 under activity-based costing?

Definitions:

Sparkling Wine

A type of wine that contains significant levels of carbon dioxide, making it fizzy, typically achieved through fermentation processes.

Manufacturer's Fault

A defect or issue in a product directly caused by the manufacturing process, resulting in consumer dissatisfaction or potential harm.

Negligence

Failure to exercise the care that a reasonably prudent person would exercise in like circumstances.

Occupiers' Liability Act

The Occupiers' Liability Act is legislation that defines the duty of care owed by individuals or entities in control of premises to those who enter the premises.

Q27: Dejarnette Corporation uses a job-order costing system

Q53: Gerstein Corporation uses a job-order costing system

Q87: Homeyer Corporation has provided the following data

Q96: Columbia Corporation produces a single product. The

Q105: Jark Corporation has invested in a machine

Q146: Morataya Corporation has two manufacturing departments--Machining and

Q172: Reck Corporation uses activity-based costing to assign

Q179: Lueckenhoff Corporation uses a job-order costing system

Q223: Jemmott Corporation has two divisions: Western Division

Q233: Last year, Kirsten Corporation's variable costing net