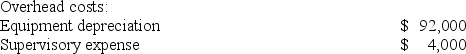

Doede Corporation uses activity-based costing to compute product margins. In the first stage, the activity-based costing system allocates two overhead accounts--equipment depreciation and supervisory expense--to three activity cost pools--Machining, Order Filling, and Other--based on resource consumption. Data to perform these allocations appear below:  Distribution of Resource Consumption Across Activity Cost Pools:

Distribution of Resource Consumption Across Activity Cost Pools: In the second stage, Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products.

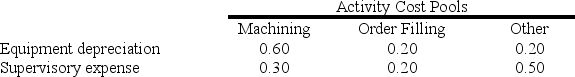

In the second stage, Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products.

Activity: Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins.

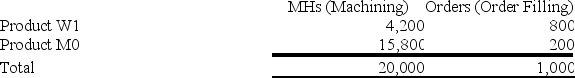

Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins.

Sales and Direct Cost Data: The activity rate for the Machining activity cost pool under activity-based costing is closest to:

The activity rate for the Machining activity cost pool under activity-based costing is closest to:

Definitions:

Taxpayer

An individual or entity that is obligated to make payments to municipal or government bodies, often in the form of taxes.

Education Expenses

Costs related to education, including tuition, books, and supplies, which may qualify for deductions or credits under tax laws.

Cost Recovery Deduction

Cost Recovery Deduction is a tax deduction that allows individuals or businesses to recover the cost of an investment or asset over time, through depreciation or amortization.

Office Furniture

Items of furniture intended for use in an office environment, including desks, chairs, and filing cabinets.

Q35: Norgaard Corporation makes 8,000 units of part

Q40: Fixed costs may be relevant in a

Q40: Ing Corporation, which has only one product,

Q76: Addleman Corporation has an activity-based costing system

Q78: Marley Corporation makes three products (X, Y,

Q111: Flemming Corporation uses activity-based costing to compute

Q115: The management of Hansley Corporation is investigating

Q124: A study has been conducted to determine

Q183: A joint product is:<br>A) any product which

Q198: Gottshall Inc. makes a range of