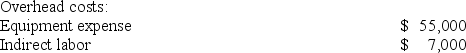

Scheuer Corporation uses activity-based costing to compute product margins. In the first stage, the activity-based costing system allocates two overhead accounts--equipment expense and indirect labor--to three activity cost pools--Processing, Supervising, and Other--based on resource consumption. Data to perform these allocations appear below:  Distribution of Resource Consumption Across Activity Cost Pools:

Distribution of Resource Consumption Across Activity Cost Pools: In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

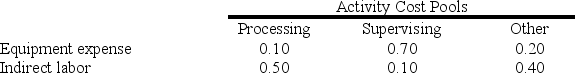

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

Activity: Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.

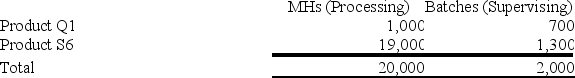

Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.

Sales and Direct Cost Data: The activity rate for the Processing activity cost pool under activity-based costing is closest to:

The activity rate for the Processing activity cost pool under activity-based costing is closest to:

Definitions:

Secondary Learning

The process of acquiring knowledge or skills that builds upon or derives from previously learned primary concepts or abilities.

Social Learning Theory

A theory that proposes learning occurs in a social context and that people learn from one another through observation, imitation, and modeling.

Traditional Behaviorism

A theory of learning based on the idea that all behaviors are acquired through conditioning without considering thoughts or feelings.

Neuropsychology

The study of the relationship between brain function and behavior, including the effects of brain injuries and diseases.

Q30: WV Construction has two divisions: Remodeling and

Q38: A manufacturing company that produces a single

Q49: Decorte Corporation uses a job-order costing system

Q87: The management of Byrge Corporation is investigating

Q109: Lambert Manufacturing has $120,000 to invest in

Q157: Schickel Inc. regularly uses material B39U and

Q174: Steele Corporation uses a predetermined overhead rate

Q196: Moskowitz Corporation has provided the following data

Q247: Sargent Corporation applies overhead cost to jobs

Q266: Bryans Corporation has provided the following data