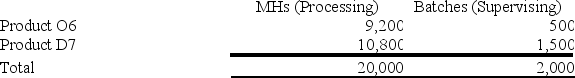

Wedd Corporation uses activity-based costing to assign overhead costs to products. Overhead costs have already been allocated to the company's three activity cost pools as follows: Processing, $27,200; Supervising, $9,300; and Other, $9,500. Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:  The activity rate for the Processing activity cost pool under activity-based costing is closest to:

The activity rate for the Processing activity cost pool under activity-based costing is closest to:

Definitions:

Copyright Act

Legislation that protects the rights of creators over their original works, such as books, music, and art, from unauthorized use.

Statute

A written law passed by a legislative body at the federal or state level.

Telecom Companies

Businesses that provide telecommunications services, such as phone, internet, and cable television services, to consumers and businesses.

Royal Assent

The formal approval by a sovereign to a piece of legislation, making it officially a law.

Q15: First-stage allocations in an ABC system should

Q57: Elfalan Corporation produces a single product. The

Q62: A company has provided the following data

Q113: The following data pertain to an investment

Q140: A product whose revenues do not cover

Q144: (Ignore income taxes in this problem.) The

Q149: The management of Furrow Corporation is considering

Q176: Lueckenhoff Corporation uses a job-order costing system

Q183: Bassett Corporation has two production departments, Milling

Q248: Parido Corporation has two manufacturing departments--Casting and