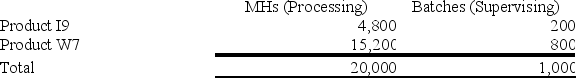

Sorice Corporation uses activity-based costing to assign overhead costs to products. Overhead costs have already been allocated to the company's three activity cost pools as follows: Processing, $20,200; Supervising, $11,000; and Other, $66,800. Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:  What is the overhead cost assigned to Product W7 under activity-based costing?

What is the overhead cost assigned to Product W7 under activity-based costing?

Definitions:

Productivity Efficiency

measures how effectively economic inputs are converted into outputs, often assessed to improve organizational workflows, resource usage, and overall performance.

Top Managers

Senior executives responsible for the overall direction and management of an organization, making strategic decisions and setting policies.

First-line Managers

Managers at the lowest level of an organization's hierarchy, directly supervising staff and overseeing day-to-day operations.

Productivity Efficiency

A metric that measures how effectively resources, such as labor and materials, are being used to produce goods and services.

Q29: When combining activities in an activity-based costing

Q54: The management of Lanzilotta Corporation is considering

Q63: Supler Corporation produces a part used in

Q65: A vertically integrated company is less dependent

Q101: Immen Corporation manufactures two products: Product B82O

Q114: Thach Corporation uses a job-order costing system

Q166: Deemer Corporation has an activity-based costing system

Q198: Pacheo Corporation, which has only one product,

Q208: Spang Corporation uses a job-order costing system

Q273: Kneeland Corporation has two divisions: Grocery Division