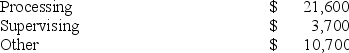

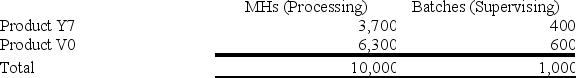

Bachrodt Corporation uses activity-based costing to compute product margins. Overhead costs have already been allocated to the company's three activity cost pools--Processing, Supervising, and Other. The costs in those activity cost pools appear below:  Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below

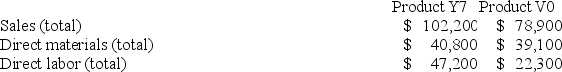

Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.

Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins. What is the overhead cost assigned to Product Y7 under activity-based costing?

What is the overhead cost assigned to Product Y7 under activity-based costing?

Definitions:

Voting Shares

Shares of a company that grant the shareholder the right to vote on company matters, such as electing the board of directors.

Fair Value

A projected cost at which property or obligation can be swapped among aware, agreeable individuals in a transaction without any undue pressure.

Stock Issuance Costs

Expenses associated with the issuance of new shares of stock, such as legal, accounting, and underwriting fees.

Consolidated Long-term Liabilities

The total amount of long-term debts that a company reports on its balance sheet, including all of its subsidiaries.

Q26: Gilchrist Corporation bases its predetermined overhead rate

Q49: Orear Corporation manufactures two products: Product Z34D

Q123: Leaper Corporation uses an activity-based costing system

Q158: Plummer Corporation has provided the following data

Q159: Torello Corporation manufactures two products: Product H95V

Q159: Ferrar Corporation has two major business segments:

Q165: The controller of Hendershot Corporation estimates the

Q174: Ouzts Corporation is considering Alternative A and

Q178: The Melville Corporation produces a single product

Q208: Musich Corporation has an activity-based costing system