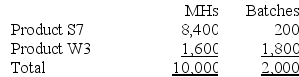

Lakey Corporation has an activity-based costing system with three activity cost pools--Machining, Setting Up, and Other. The company's overhead costs have already been allocated to the cost pools and total $11,000 for the Machining cost pool, $26,200 for the Setting Up cost pool, and $9,800 for the Other cost pool. Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. Data concerning the two products appear below:

Required:

Required:

a. Calculate activity rates for each activity cost pool using activity-based costing.

b. Determine the amount of overhead cost that would be assigned to each product using activity-based costing.

Definitions:

Detritus

Partially decomposed organic matter, often found in natural environments, serving as a nutrient source for some organisms.

Decaying Organic Matter

Organic material breaking down through the process of decomposition, typically by microbial action.

Q27: Dejarnette Corporation uses a job-order costing system

Q29: Silver Corporation produces a single product. Last

Q55: Levron Corporation uses a job-order costing system

Q73: Dercole Corporation uses activity-based costing to assign

Q79: Generally speaking, net operating income under variable

Q95: Ing Corporation, which has only one product,

Q130: Spang Corporation uses a job-order costing system

Q155: Stinehelfer Beet Processors, Inc., processes sugar beets

Q214: Kostelnik Corporation uses a job-order costing system

Q261: Lean production should result in reduced inventories.