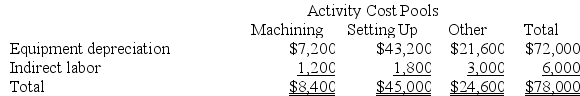

Musich Corporation has an activity-based costing system with three activity cost pools--Machining, Setting Up, and Other. The company's overhead costs, which consist of equipment depreciation and indirect labor, have been allocated to the cost pools already and are provided in the table below.

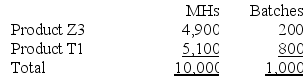

Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. Data concerning the two products and the company's costs appear below:

Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. Data concerning the two products and the company's costs appear below:

Required:

Required:

a. Calculate activity rates for each activity cost pool using activity-based costing.

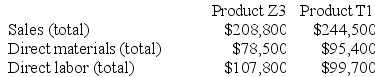

b. Determine the amount of overhead cost that would be assigned to each product using activity-based costing.

c. Determine the product margins for each product using activity-based costing.

Definitions:

Proofread

The process of reading and correcting written material to ensure it is free of errors.

Independent Clause

A group of words that contains a subject and a verb and expresses a complete thought, capable of standing alone as a sentence.

Enumerated Lists

Ordered lists where items are numbered or listed with bullet points to organize information clearly.

Bulleted Lists

A series of items or points presented with bullet symbols to organize information or highlight key aspects.

Q9: Scholfield Enterprises makes a variety of products

Q32: Accepting a special order will improve overall

Q36: Cranston Corporation makes four products in a

Q47: Malakan Corporation has two production departments, Machining

Q102: Mundorf Corporation has two manufacturing departments--Forming and

Q110: Provenzano Corporation manufactures two products: Product B56Z

Q144: (Ignore income taxes in this problem.) The

Q167: Larry Enterprises makes a variety of products

Q174: Vito Corporation manufactures two products: Product F77I

Q250: Harootunian Corporation uses a job-order costing system