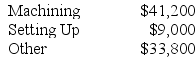

Greife Corporation's activity-based costing system has three activity cost pools--Machining, Setting Up, and Other. The company's overhead costs have already been allocated to these cost pools as follows:

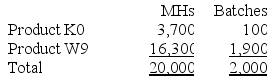

Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. The following table shows the machine-hours and number of batches associated with each of the company's two products:

Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. The following table shows the machine-hours and number of batches associated with each of the company's two products:

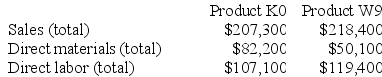

Additional data concerning the company's products appears below:

Additional data concerning the company's products appears below:

Required:

Required:

a. Calculate activity rates for each activity cost pool using activity-based costing.

b. Determine the amount of overhead cost that would be assigned to each product using activity-based costing.

c. Determine the product margins for each product using activity-based costing.

Definitions:

PowerPoint Slides

Digital slides created using Microsoft PowerPoint software, designed for visual presentations where information is displayed in a slideshow format.

Cellphone Communication

The transmission of information using cellular technology, enabling voice and data exchange over a distance via mobile devices.

Time Zones

Geographic regions defined by the same standard time, resulting from the division of the Earth's surface into zones of equal time offset from Coordinated Universal Time (UTC).

Voice Mail Technology

A system that allows users to exchange personal voice messages using a phone or a computer.

Q45: Cranston Corporation makes four products in a

Q52: In a factory operating at capacity, every

Q78: Purchase order processing is an example of

Q146: Handal Corporation uses activity-based costing to compute

Q180: Younes Inc. manufactures industrial components. One of

Q185: Baughn Corporation, which has only one product,

Q186: Ferrar Corporation has two major business segments:

Q194: Jemmott Corporation has two divisions: Western Division

Q208: Corbel Corporation has two divisions: Division A

Q263: Croft Corporation produces a single product. Last