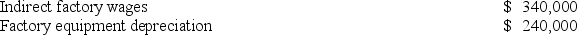

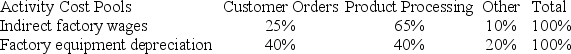

Weldon Corporation has provided the following data from its activity-based costing accounting system:  Distribution of Resource Consumption across Activity Cost Pools:

Distribution of Resource Consumption across Activity Cost Pools: The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs that are not assigned to products.

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs that are not assigned to products.

How much indirect factory wages and factory equipment depreciation cost would be assigned to the Customer Orders activity cost pool?

Definitions:

Period

In accounting, a period is a length of time during which financial activities are recorded and reported, such as a month, quarter, or year.

Calculate

To ascertain or compute a figure or amount through mathematical processes.

Period

A specific span of time during which certain financial activities or measurements are recorded and assessed.

Cost of Goods Manufactured

The total expense incurred by a company to produce goods in a given period, including materials, labor, and overhead costs.

Q26: The book value of an old machine

Q49: The Tolar Corporation has 400 obsolete desk

Q83: Holden Corporation produces three products, with costs

Q109: The Tolar Corporation has 400 obsolete desk

Q142: Ober Corporation, which has only one product,

Q174: Steele Corporation uses a predetermined overhead rate

Q193: Assuming the LIFO inventory flow assumption, when

Q200: Dobles Corporation has provided the following data

Q244: In a job-order cost system, indirect labor

Q270: The following data have been recorded for