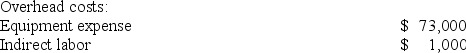

Addleman Corporation has an activity-based costing system with three activity cost pools--Processing, Supervising, and Other. In the first stage allocations, costs in the two overhead accounts, equipment expense and indirect labor, are allocated to the three activity cost pools based on resource consumption. Data used in the first stage allocations follow:  Distribution of Resource Consumption Across Activity Cost Pools:

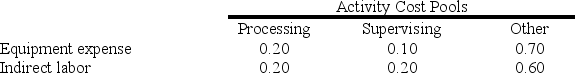

Distribution of Resource Consumption Across Activity Cost Pools: Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

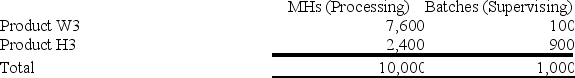

Activity: Finally, the costs of Processing and Supervising are combined with the following sales and direct cost data to determine product margins.

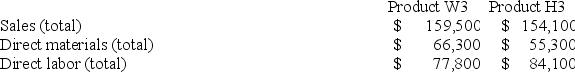

Finally, the costs of Processing and Supervising are combined with the following sales and direct cost data to determine product margins.

Sales and Direct Cost Data: What is the overhead cost assigned to Product H3 under activity-based costing?

What is the overhead cost assigned to Product H3 under activity-based costing?

Definitions:

Q17: Kirsten Corporation makes 100,000 units per year

Q28: (Ignore income taxes in this problem.) Jim

Q54: The management of Lanzilotta Corporation is considering

Q110: Else Corporation has provided the following data

Q141: Simila Corporation has provided the following data

Q165: Parks Corporation is considering an investment proposal

Q170: Which of the following will usually be

Q171: Bruce Corporation makes four products in a

Q250: Harootunian Corporation uses a job-order costing system

Q254: Elison Corporation, which has only one product,