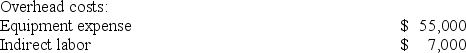

Scheuer Corporation uses activity-based costing to compute product margins. In the first stage, the activity-based costing system allocates two overhead accounts--equipment expense and indirect labor--to three activity cost pools--Processing, Supervising, and Other--based on resource consumption. Data to perform these allocations appear below:  Distribution of Resource Consumption Across Activity Cost Pools:

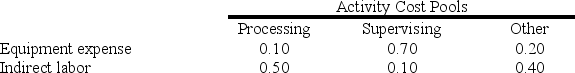

Distribution of Resource Consumption Across Activity Cost Pools: In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

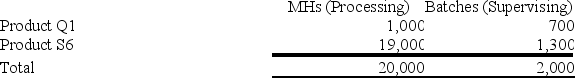

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

Activity: Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.

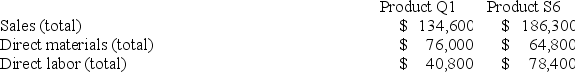

Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.

Sales and Direct Cost Data: How much overhead cost is allocated to the Processing activity cost pool under activity-based costing in the first stage of allocation?

How much overhead cost is allocated to the Processing activity cost pool under activity-based costing in the first stage of allocation?

Definitions:

Split Mind

Split mind, often associated with schizophrenia, describes a condition characterized by a fragmented thought process and a lack of integration of thoughts and emotions.

Literally Translated

"Literally Translated" refers to the exact word-for-word translation of text from one language to another without altering the original meaning or context.

Neurotransmitter Activity

The process by which chemicals in the brain are released and received by neurons, facilitating communication between brain cells.

Antidepressant Drugs

Medications used to treat depressive disorders by altering chemicals in the brain associated with mood regulation.

Q1: Oriental Corporation has gathered the following data

Q21: Basta Corporation has provided the following data

Q97: Scholfield Enterprises makes a variety of products

Q138: Doakes Corporation uses a job-order costing system

Q141: Simila Corporation has provided the following data

Q148: Fausnaught Corporation has two major business segments--Retail

Q157: Mccrone Corporation has provided the following data

Q160: Gerstein Corporation uses a job-order costing system

Q210: In a job-order costing system, costs are

Q213: Bippus Corporation manufactures two products: Product X08R