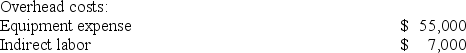

Scheuer Corporation uses activity-based costing to compute product margins. In the first stage, the activity-based costing system allocates two overhead accounts--equipment expense and indirect labor--to three activity cost pools--Processing, Supervising, and Other--based on resource consumption. Data to perform these allocations appear below:  Distribution of Resource Consumption Across Activity Cost Pools:

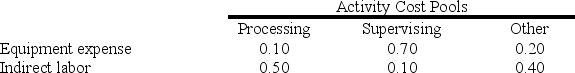

Distribution of Resource Consumption Across Activity Cost Pools: In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

Activity: Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.

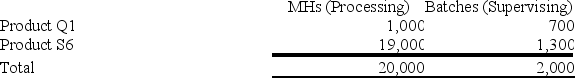

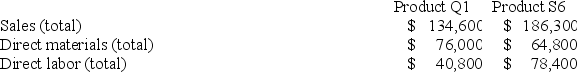

Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.

Sales and Direct Cost Data: What is the overhead cost assigned to Product Q1 under activity-based costing?

What is the overhead cost assigned to Product Q1 under activity-based costing?

Definitions:

Social Entrepreneurs

Social entrepreneurs are individuals who start innovative businesses with the primary goal of solving social problems and improving society.

Innovative Solutions

Novel ideas or methods that address existing problems or needs in a unique or more effective way.

Societal Problem

An issue that affects a large number of people within a society, typically requiring collective efforts for resolution.

Entrepreneurship Growth

The expansion and scaling of entrepreneurial activities and businesses, characterized by increased output, innovation, and market share.

Q11: Muckleroy Corporation has two divisions: Division K

Q24: Wood Carving Corporation manufactures three products. Because

Q31: Digerolamo Enterprises makes a variety of products

Q61: Foggs Corporation has provided the following data

Q69: Designing a new backpack at an outdoor

Q107: Suire Corporation is considering dropping product D14E.

Q117: Anglen Co. manufactures and sells trophies

Q130: Keyser Corporation, which has only one product,

Q142: The management of Hibert Corporation is considering

Q275: If a job is not completed at