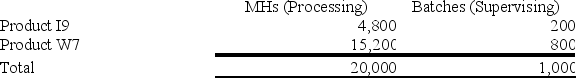

Sorice Corporation uses activity-based costing to assign overhead costs to products. Overhead costs have already been allocated to the company's three activity cost pools as follows: Processing, $20,200; Supervising, $11,000; and Other, $66,800. Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:  What is the overhead cost assigned to Product W7 under activity-based costing?

What is the overhead cost assigned to Product W7 under activity-based costing?

Definitions:

Comorbidity

The concurrent occurrence of multiple diseases or medical conditions within the same patient.

Personality Disorders

A group of mental disorders characterized by enduring maladaptive patterns of behavior, cognition, and inner experience, exhibited across many contexts and deviating from those accepted by the individual's culture.

Maladaptive Efforts

Behavior strategies or patterns that adversely affect a person's ability to adapt to situations or stress, often preventing proper or healthy responses.

Anxiety

The state of being nervous, fretful, or uneasy due to an event whose outcome is uncertain.

Q3: Which of the following would be classified

Q30: WV Construction has two divisions: Remodeling and

Q39: A complete income statement need not be

Q76: Addleman Corporation has an activity-based costing system

Q89: Mcinture Enterprises makes a variety of products

Q119: The Jabba Corporation manufactures the "Snack Buster"

Q137: The following are Silver Corporation's unit costs

Q143: Bertie Corporation has two divisions: Retail Division

Q193: Bertsche Enterprises makes a variety of products

Q236: Columbia Corporation produces a single product. The