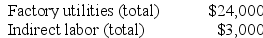

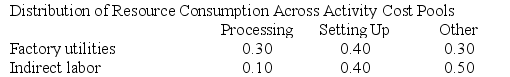

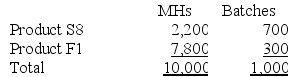

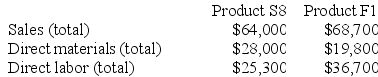

Groleau Corporation has an activity-based costing system with three activity cost pools--Processing, Setting Up, and Other. The company's overhead costs, which consist of factory utilities and indirect labor, are allocated to the cost pools in proportion to the activity cost pools' consumption of resources. Costs in the Processing cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. Data concerning the two products and the company's costs and activity-based costing system appear below:

Required:

Required:

a. Assign overhead costs to activity cost pools using activity-based costing.

b. Calculate activity rates for each activity cost pool using activity-based costing.

c. Determine the amount of overhead cost that would be assigned to each product using activity-based costing.

d. Determine the product margins for each product using activity-based costing.

Definitions:

Q4: Holton Company makes three products in a

Q32: Becker Billing Systems, Inc., has an antiquated

Q93: Bertie Corporation has two divisions: Retail Division

Q95: Ing Corporation, which has only one product,

Q98: Sivret Corporation uses a job-order costing system

Q114: (Ignore income taxes in this problem.) The

Q150: Rhea Corporation has provided the following data

Q153: Bachrodt Corporation uses activity-based costing to compute

Q161: Houseal Corporation has provided the following data

Q277: Clemeson Corporation, which has only one product,