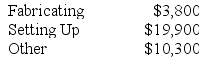

Sukhu Corporation's activity-based costing system has three activity cost pools--Fabricating, Setting Up, and Other. The company's overhead costs have already been allocated to these cost pools as follows:

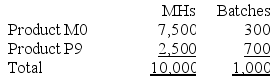

Costs in the Fabricating cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. The following table shows the machine-hours and number of batches associated with each of the company's two products:

Costs in the Fabricating cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. The following table shows the machine-hours and number of batches associated with each of the company's two products:

Required:

Required:

Calculate activity rates for each activity cost pool using activity-based costing.

Definitions:

Ordinal Data

Data that represent order or ranking among categories but do not quantify the difference between categories, such as educational levels or satisfaction ratings.

Ranking Procedure

A ranking procedure is a statistical method used to assign ranks to various items or entities based on certain attributes or measurements.

Analysis of Variance (ANOVA)

A statistical method used to test the difference between two or more means by analyzing variances.

T-test

A statistical test used to compare the mean of a sample to a known value, or the means of two samples, to assess if the differences are statistically significant.

Q26: Hails Corporation manufactures two products: Product Q21F

Q55: Levron Corporation uses a job-order costing system

Q63: Placker Corporation uses a job-order costing system

Q72: In the second-stage allocation in activity-based costing,

Q77: A reason why absorption costing income statements

Q104: Diehl Corporation uses an activity-based costing system

Q124: Farris Corporation, which has only one product,

Q160: The management of Ro Corporation is investigating

Q165: Aaron Corporation, which has only one product,

Q272: Baraban Corporation has provided the following data