Neas Corporation has an activity-based costing system with three activity cost pools--Machining, Setting Up, and Other. The company's overhead costs have already been allocated to the cost pools and total $25,200 for the Machining cost pool, $17,200 for the Setting Up cost pool, and $41,600 for the Other cost pool.

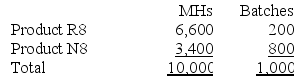

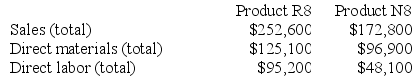

Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. Data concerning the two products and the company's costs appear below:

Required:

Required:

a. Calculate activity rates for each activity cost pool using activity-based costing.

b. Determine the amount of overhead cost that would be assigned to each product using activity-based costing.

c. Determine the product margins for each product using activity-based costing.

Definitions:

Rich Format Content Control

A feature in document creation software that allows for the inclusion of enriched text formatting, such as bold or italic, within form fields.

Page Color

A feature in document and presentation software that allows the user to set the background color of a page or slide.

Design Tab

A feature in many software applications that provides tools and options for modifying the appearance or layout of a document or presentation.

Background

The part of a visual image or page that lies behind the main objects of interest, setting the scene or context.

Q13: Archie Corporation uses the following activity rates

Q24: If a cost must be arbitrarily allocated

Q48: (Ignore income taxes in this problem.) The

Q77: Leber Enterprises makes a variety of products

Q97: Morrel University has a small shuttle bus

Q107: Immen Corporation manufactures two products: Product B82O

Q144: The Silver Corporation uses a predetermined overhead

Q157: (Ignore income taxes in this problem.) Wary

Q194: Kubes Corporation uses a job-order costing system

Q231: Farris Corporation, which has only one product,