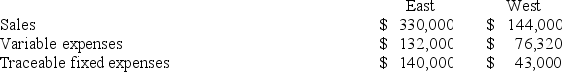

Fernstrom Corporation has two divisions: East and West. Data from the most recent month appear below:  The company's common fixed expenses total $52,140. If the company operates at exactly the break-even sales of the East Division and West Division, what would be the company's overall net operating income?

The company's common fixed expenses total $52,140. If the company operates at exactly the break-even sales of the East Division and West Division, what would be the company's overall net operating income?

Definitions:

Excise Taxes

Taxes levied on specific goods or services, such as alcohol and tobacco, often intended to discourage their use or raise revenue.

Progressive

A social or political ideology that advocates for reform and innovation, emphasizing progressive changes in society.

Direct Taxes

Taxes levied directly on an individual's or organization's income or wealth.

Marginal Tax Rate

The percentage of tax levied on each additional dollar of income, representing the tax rate applicable to every tax bracket for which you're eligible.

Q13: Costs that can be eliminated in whole

Q29: Marsdon Company has an annual production

Q78: Kalp Corporation has two production departments, Machining

Q80: Figge & Mathews PLC, a consulting firm,

Q93: The management of Bonga Corporation is considering

Q106: Kreuzer Corporation is using a predetermined overhead

Q118: Companies often allocate common fixed costs among

Q191: Opunui Corporation has two manufacturing departments--Molding and

Q240: Nuzum Corporation has two divisions: Division M

Q279: Last year, Rasband Corporation's variable costing net