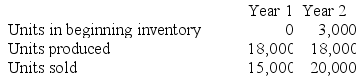

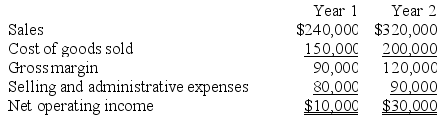

Fowler Corporation manufactures a single product. Operating data for the company and its absorption costing income statements for the last two years are presented below:

Variable manufacturing costs are $6 per unit. Fixed manufacturing overhead totals $72,000 in each year. This fixed manufacturing overhead is applied at the rate of $4 per unit. Variable selling and administrative expenses are $2 per unit sold.

Variable manufacturing costs are $6 per unit. Fixed manufacturing overhead totals $72,000 in each year. This fixed manufacturing overhead is applied at the rate of $4 per unit. Variable selling and administrative expenses are $2 per unit sold.

Required:

a. Compute the unit product cost in each year under variable costing.

b. Prepare new income statements for each year using variable costing.

c. Reconcile the absorption costing and variable costing net operating income for each year.

Definitions:

Community's Preference

A concept in economics and social sciences that refers to the collective decision-making or tastes of a community as a whole.

Paired-Choice Votes

A voting method in which voters choose between pairs of candidates or options in a series of rounds to determine the most preferred option or candidate.

Paradox of Voting

The paradox of voting is a situation where the costs of voting (time, effort) exceed the apparent benefits, given the low probability of one vote being decisive, yet people still vote.

New Park

A newly established or developed public area designed for recreation, leisure, and conservation purposes.

Q2: Claybrooks Corporation has two manufacturing departments--Casting and

Q33: Wedd Corporation uses activity-based costing to assign

Q38: Mcewan Corporation uses a job-order costing system

Q61: Foggs Corporation has provided the following data

Q156: Fernstrom Corporation has two divisions: East and

Q162: Wolanski Corporation has provided the following data

Q198: Pacheo Corporation, which has only one product,

Q228: A decrease in the number of units

Q239: Data for January for Bondi Corporation and

Q283: Under variable costing, all variable production costs