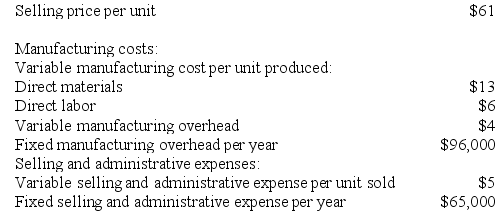

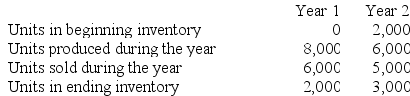

Sherwood Corporation has provided the following data for its two most recent years of operation:

Required:

Required:

a. Assume the company uses absorption costing. Compute the unit product cost in each year.

b. Assume the company uses variable costing. Compute the unit product cost in each year.

c. Assume the company uses absorption costing. Prepare an income statement for each year.

d. Assume the company uses variable costing. Prepare an income statement for each year.

e. Prepare a report in good form reconciling the variable costing and absorption costing net incomes.

Definitions:

Departmental Overhead Rates

Different rates used to allocate overhead costs to products or job functions, based on department-specific activities.

Direct Labor Hours

The total hours worked by employees who are directly involved in the production process of goods or services.

PVC Fencing

A fencing material made from polyvinyl chloride, known for its durability, weather resistance, and low maintenance requirements.

Plantwide Overhead Rate

A unified rate employed across the entire manufacturing facility to allocate overhead expenses to products.

Q96: Opunui Corporation has two manufacturing departments--Molding and

Q101: Aaron Corporation, which has only one product,

Q113: Hayworth Corporation has just segmented last year's

Q162: Perl Corporation uses an activity-based costing system

Q208: Musich Corporation has an activity-based costing system

Q210: A manufacturing company that produces a single

Q221: Ross Corporation produces a single product. The

Q253: Allocating common fixed costs to segments on

Q262: Beans Corporation uses a job-order costing system

Q286: The Southern Corporation manufactures a single product