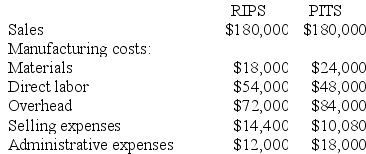

Omstadt Corporation produces and sells only two products that are referred to as RIPS and PITS. Production is "for order" only, and no finished goods inventories are maintained; work in process inventories are negligible. The following data relate to last month's operations:

$36,000 of the manufacturing overhead assigned to RIPS and $72,000 of that assigned to PITS is fixed. The balance of the overhead is variable. Selling expenses consist entirely of commissions paid as a percentage of sales. Direct labor is completely variable. Administrative expenses are fixed and cannot be traced to the products but have been arbitrarily allocated to the products.

$36,000 of the manufacturing overhead assigned to RIPS and $72,000 of that assigned to PITS is fixed. The balance of the overhead is variable. Selling expenses consist entirely of commissions paid as a percentage of sales. Direct labor is completely variable. Administrative expenses are fixed and cannot be traced to the products but have been arbitrarily allocated to the products.

Required:

Prepare a segmented income statement, in total and for the two products. Use the contribution approach.

Definitions:

Program Evaluators

Professionals who systematically assess the design, implementation, and outcomes of programs to determine their effectiveness and improve future outcomes.

Pertinent Data

Relevant or applicable data that directly relate to the matter at hand or the research question being investigated.

Analyzed

The process of examining data or information in detail to identify patterns, significance, or specific characteristics.

Counseling Process

A structured interaction between a counselor and a client focused on addressing the client's emotional, psychological, and life challenges.

Q44: Daher Corporation manufactures two products: Product A34R

Q61: Bernson Corporation is using a predetermined overhead

Q76: Souza Inc, which produces and sells a

Q77: Maruca Corporation has provided the following contribution

Q89: The degree of operating leverage is computed

Q94: Absorption costing treats all manufacturing costs as

Q146: Handal Corporation uses activity-based costing to compute

Q179: Data concerning Follick Corporation's single product appear

Q243: Kluth Corporation has two manufacturing departments--Molding and

Q275: Danahy Corporation manufactures a single product. The