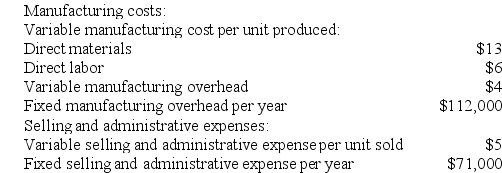

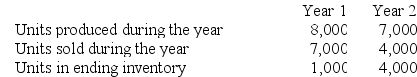

Boylston Corporation has provided the following data for its two most recent years of operation. The company makes a product that it sells for $75 per unit. It began Year 1 with no units in beginning inventory.

Required:

Required:

a. Assume the company uses absorption costing. Compute the unit product cost in each year.

b. Assume the company uses variable costing. Compute the unit product cost in each year.

c. Assume the company uses absorption costing. Prepare an income statement for each year.

d. Assume the company uses variable costing. Prepare an income statement for each year.

Definitions:

Dissociate

To separate or remove from association; in chemistry, it refers to the reversible separation of molecules into smaller particles.

Buffers

Chemical substances that help maintain the stability of pH levels in solutions by neutralizing the effects of acids and bases.

Covalent Bonds

Chemical connections where two atoms share electrons mutually, contributing to the formation and structure of molecules.

Polarity

Separation of charge into distinct positive and negative regions.

Q26: Mcdale Inc. produces and sells two products.

Q45: Clenney Corporation uses a plantwide overhead rate

Q49: Decorte Corporation uses a job-order costing system

Q93: Mossfeet Shoe Corporation is a single product

Q96: Steffen Corporation has three products with the

Q101: Aaron Corporation, which has only one product,

Q155: Levi Corporation uses a predetermined overhead rate

Q189: Eisentrout Corporation has two production departments, Machining

Q223: Product Y sells for $15 per unit,

Q259: Gabuat Corporation, which has only one product,