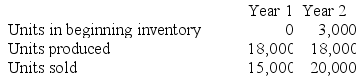

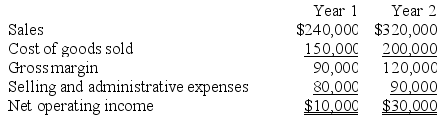

Fowler Corporation manufactures a single product. Operating data for the company and its absorption costing income statements for the last two years are presented below:

Variable manufacturing costs are $6 per unit. Fixed manufacturing overhead totals $72,000 in each year. This fixed manufacturing overhead is applied at the rate of $4 per unit. Variable selling and administrative expenses are $2 per unit sold.

Variable manufacturing costs are $6 per unit. Fixed manufacturing overhead totals $72,000 in each year. This fixed manufacturing overhead is applied at the rate of $4 per unit. Variable selling and administrative expenses are $2 per unit sold.

Required:

a. Compute the unit product cost in each year under variable costing.

b. Prepare new income statements for each year using variable costing.

c. Reconcile the absorption costing and variable costing net operating income for each year.

Definitions:

Q13: Wyrich Corporation has two divisions: Blue Division

Q51: Common fixed expenses should not be allocated

Q85: Beach Corporation, which produces a single product,

Q107: Immen Corporation manufactures two products: Product B82O

Q115: Wimpy Inc. produces and sells a single

Q118: Leeds Corporation uses a job-order costing system

Q167: Larry Enterprises makes a variety of products

Q206: Younan Corporation manufactures two products: Product E47F

Q217: Vanliere Corporation has two production departments, Machining

Q242: Cassius Corporation has provided the following contribution