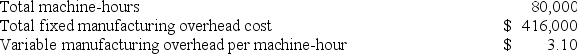

Dejarnette Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on the following data:  The predetermined overhead rate is closest to:

The predetermined overhead rate is closest to:

Definitions:

Treasury Bond

A Treasury bond is a long-term government debt security with a maturity of more than ten years, issued by the U.S. Department of the Treasury, and is backed by the U.S. government's credit.

Current Yield

The annual income (interest or dividends) divided by the current price of the security, often used to measure the return on investment of bonds.

Coupon Rate

The interest rate the issuer of a bond agrees to pay annually to the holder, expressed as a percentage of the bond's face value.

Quoted

Refers to stating the current price of a stock, bond, commodity, or any financial instrument, or the most recent bid and ask prices available.

Q15: Prime cost equals manufacturing overhead cost.

Q31: Neef Corporation has provided the following data

Q56: Junior Bodway, Inc., has provided the following

Q142: Iverson Corporation's variable expenses are 60% of

Q157: Tropp Corporation sells a product for $10

Q182: Addleman Corporation has an activity-based costing system

Q203: Alsobrooks Corporation uses a job-order costing system

Q248: Elbrege Corporation manufactures a single product. The

Q255: Haslem Inc. has provided the following data

Q272: Baraban Corporation has provided the following data