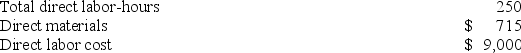

Branin Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on total fixed manufacturing overhead cost of $160,000, variable manufacturing overhead of $3.40 per direct labor- hour, and 80,000 direct labor-hours. The company has provided the following data concerning Job A578 which was recently completed:  The estimated total manufacturing overhead is closest to:

The estimated total manufacturing overhead is closest to:

Definitions:

Capital Gain Distributions

The payment of proceeds realized from the sale of an asset held in a mutual fund or ETF, distributed to investors as a taxable distribution.

Income Distributions

Payments, often periodic, received by investors from assets they own, such as dividends from stocks or interest from bonds.

Rate of Return

The increase or decrease in the value of an investment during a set period, represented as a proportion of the investment's original price.

Q72: Derst Inc. sells a particular textbook for

Q79: Horgen Corporation manufactures two products: Product M68B

Q79: Houpe Corporation produces and sells a single

Q87: The July contribution format income statement of

Q87: Homeyer Corporation has provided the following data

Q105: Nissley Wedding Fantasy Corporation makes very elaborate

Q122: Plummer Corporation has provided the following data

Q188: Houpe Corporation produces and sells a single

Q204: Neef Corporation has provided the following data

Q253: Mishoe Corporation has provided the following contribution