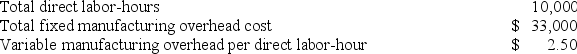

Decorte Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on the following data:  Recently, Job K332 was completed with the following characteristics:

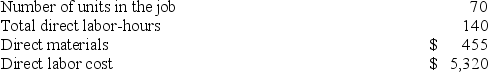

Recently, Job K332 was completed with the following characteristics: The total job cost for Job K332 is closest to: (Round your intermediate calculations to 2 decimal places.)

The total job cost for Job K332 is closest to: (Round your intermediate calculations to 2 decimal places.)

Definitions:

Finished Goods Ledger

The subsidiary ledger that contains the individual accounts for each kind of commodity or product produced.

Deferred Revenue

Money received by a company for goods or services yet to be delivered or performed; classified as a liability on the balance sheet until the transaction is completed.

Product Costs

All costs incurred to acquire or produce a product that is intended for sale, including materials, labor, and overhead.

Sales

The activities involved in selling goods or services to customers for money.

Q55: In the most recent month, Sardella Corporation's

Q63: Zanetti Corporation produces and sells a single

Q80: Merati Corporation has two manufacturing departments--Forming and

Q89: The degree of operating leverage is computed

Q140: Mcmurtry Corporation sells a product for $170

Q148: Jerrel Corporation sells a product for $230

Q160: Gerstein Corporation uses a job-order costing system

Q211: Which of the following is an assumption

Q232: Boward Corporation has two production departments, Milling

Q253: Mishoe Corporation has provided the following contribution