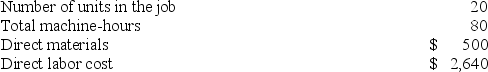

Levron Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on total fixed manufacturing overhead cost of $58,000, variable manufacturing overhead of $2.00 per machine-hour, and 20,000 machine-hours. The company has provided the following data concerning Job P978 which was recently completed:  The predetermined overhead rate is closest to:

The predetermined overhead rate is closest to:

Definitions:

Interest Revenue

Income earned from lending funds or investing in interest-bearing financial instruments.

Adjusting Entry

A journal entry made at the end of an accounting period to allocate income and expenditure to the appropriate period.

Wages Expense

Costs incurred by a company for the payment of hourly employee wages within a specific accounting period.

Accumulated Depreciation

The total depreciation for a fixed asset that has been charged to expense since that asset was acquired and made available for use.

Q36: Bellue Inc. manufactures a single product. Variable

Q72: Derst Inc. sells a particular textbook for

Q75: Bois Corporation has provided its contribution format

Q116: Merati Corporation has two manufacturing departments--Forming and

Q120: Aaron Corporation, which has only one product,

Q128: Vancott Inc., which produces a single product,

Q155: Levi Corporation uses a predetermined overhead rate

Q234: A company makes a single product that

Q253: Mishoe Corporation has provided the following contribution

Q258: Break-even analysis assumes that:<br>A) Total revenue is