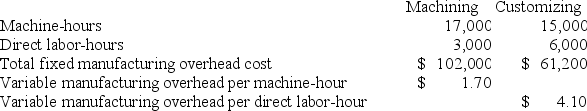

Collini Corporation has two production departments, Machining and Customizing. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Machining Department's predetermined overhead rate is based on machine-hours and the Customizing Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:  During the current month the company started and finished Job T268. The following data were recorded for this job:

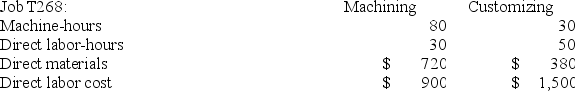

During the current month the company started and finished Job T268. The following data were recorded for this job: The total job cost for Job T268 is closest to: (Round your intermediate calculations to 2 decimal places.)

The total job cost for Job T268 is closest to: (Round your intermediate calculations to 2 decimal places.)

Definitions:

Bonds

Debt securities issued by corporations or governments to raise funds, promising to pay back the principal along with interest.

Carrying Value

The book value of an asset or liability on a company's balance sheet, taking into account depreciation, amortization, and impairment charges.

Noncontrolling Interest

An ownership position in which a shareholder owns less than 50% of a company's stock and therefore has no control over decisions.

Consolidated Statement

A financial statement that presents the assets, liabilities, and operating results of a parent company and its subsidiaries as one single entity.

Q16: Traditional format income statements are widely used

Q51: Housholder Corporation uses a predetermined overhead rate

Q118: Waltzer Corporation has provided the following data

Q122: Braegelmann Corporation has two production departments, Casting

Q125: Toxemia Salsa Corporation manufactures five flavors of

Q153: Wyrich Corporation has two divisions: Blue Division

Q154: Within the relevant range, variable costs can

Q212: Variable costing is more compatible with cost-volume-profit

Q264: Succulent Juice Corporation manufactures and sells premium

Q275: Which of the following statements is true