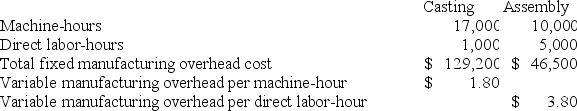

Tiff Corporation has two production departments, Casting and Assembly. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Casting Department's predetermined overhead rate is based on machine-hours and the Assembly Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:  During the current month the company started and finished Job P131. The following data were recorded for this job:

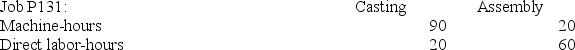

During the current month the company started and finished Job P131. The following data were recorded for this job: The predetermined overhead rate for the Casting Department is closest to:

The predetermined overhead rate for the Casting Department is closest to:

Definitions:

Opportunity Costs of War

The economic resources and benefits that are forgone by engaging in war, including the impact on trade, development, and the allocation of government spending.

International Trade

The international transfer of goods, services, and capital across national boundaries or regions.

Barriers to Free Trade

Restrictions, such as tariffs, quotas, and regulations, imposed by governments to control international trade and protect domestic industries.

International Allocation

The distribution of resources, goods, or capital among countries around the globe according to various economic factors and policies.

Q12: Bellucci Corporation has provided the following information:

Q37: Assuming that direct labor is a variable

Q89: Data for January for Bondi Corporation and

Q99: To obtain the dollar sales volume necessary

Q162: Sabv Corporation's break-even-point in sales is $675,000,

Q174: Steele Corporation uses a predetermined overhead rate

Q221: The following data pertains to activity and

Q241: Caneer Corporation produces and sells a single

Q265: Pavelko Corporation has provided the following data

Q270: The following data have been recorded for