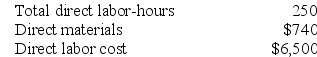

Mcewan Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on 20,000 direct labor-hours, total fixed manufacturing overhead cost of $182,000, and a variable manufacturing overhead rate of $2.50 per direct labor-hour. Job X941, which was for 50 units of a custom product, was recently completed. The job cost sheet for the job contained the following data:

Required:

Required:

Calculate the selling price for Job X941 if the company marks up its unit product costs by 20%.

Definitions:

Debt Securities

Financial instruments indicating a debt owed by the issuer to the holder, typically in the form of bonds, bills, or notes.

Available-for-sale Securities

Financial assets not classified as held-to-maturity or trading securities, and can be sold in the market.

Significant Influence

The capacity to affect the operating and financial decisions of another entity, typically through ownership of a substantial share of its stock.

Voting Stock

Shares that give the shareholder voting rights in the corporation's matters, typically related to the election of the board of directors.

Q1: Deloria Corporation has two production departments, Forming

Q7: Quiet Corporation uses a job-order costing system

Q19: Danahy Corporation manufactures a single product. The

Q83: The cost of direct materials is classified

Q106: Kreuzer Corporation is using a predetermined overhead

Q130: Spang Corporation uses a job-order costing system

Q147: Data concerning Kardas Corporation's single product appear

Q147: Eisentrout Corporation has two production departments, Machining

Q232: Neef Corporation has provided the following data

Q270: In account analysis, an account is classified