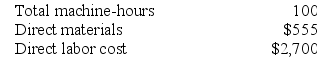

Cardosa Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on 70,000 machine-hours, total fixed manufacturing overhead cost of $308,000, and a variable manufacturing overhead rate of $2.10 per machine-hour. Job M556, which was for 50 units of a custom product, was recently completed. The job cost sheet for the job contained the following data:

Required:

Required:

a. Calculate the total job cost for Job M556.

b. Calculate the unit product cost for Job M556.

Definitions:

Property Taxes

Taxes levied by local governments on real estate based on the property's assessed value, used to fund public services.

Indirect Materials

Materials used in the production process that cannot be directly linked to specific product units, such as lubricants and cleaning supplies used in machinery.

Total Fixed Costs

The combined sum of all costs that do not change with the level of production or sales over a short period.

Master Budget

The total of all individual budgets within an organization, projecting all major financial activities over a period.

Q39: Brault Corporation has provided the following information:

Q40: Decorte Corporation uses a job-order costing system

Q61: Majid Corporation sells a product for $240

Q118: Cubie Corporation has provided the following data

Q138: The three cost elements ordinarily included in

Q164: The Southern Corporation manufactures a single product

Q193: A $2.00 increase in a product's variable

Q197: Juanita Corporation uses a job-order costing system

Q210: Heathman Inc. produces and sells a single

Q213: Wyrich Corporation has two divisions: Blue Division