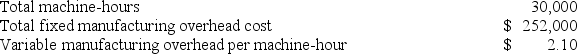

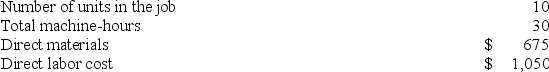

Lupo Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on the following data:  Recently, Job T687 was completed with the following characteristics:

Recently, Job T687 was completed with the following characteristics: The estimated total manufacturing overhead is closest to:

The estimated total manufacturing overhead is closest to:

Definitions:

Sympathetic Arousal

The activation of the sympathetic nervous system, leading to physiological changes such as increased heart rate, blood pressure, and energy release, often in response to stress or danger.

Tend-And-Befriend Response

under stress, people (especially women) often provide support to others (tend) and bond withand seek support from others (befriend).

Psychoneuroimmunology

The study of how psychological, neural, and endocrine processes together affect the immune system and resulting health.

General Adaptation Syndrome

A model describing the body's short-term and long-term reactions to stress, including stages of alarm, resistance, and exhaustion.

Q1: Mason Corporation's selling price was $20 per

Q2: Kray Inc., which produces a single product,

Q45: Clenney Corporation uses a plantwide overhead rate

Q74: Ahlheim Corporation has two production departments, Forming

Q82: The following costs are all examples of

Q87: Macnamara Corporation has two manufacturing departments--Casting and

Q110: Which of the following would usually be

Q139: Within the relevant range, a change in

Q160: Gerstein Corporation uses a job-order costing system

Q239: Nocum Corporation has provided the following contribution