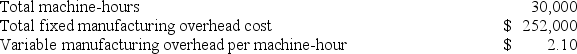

Lupo Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on the following data:  Recently, Job T687 was completed with the following characteristics:

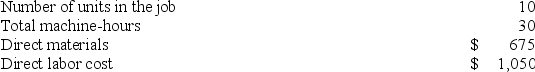

Recently, Job T687 was completed with the following characteristics: If the company marks up its unit product costs by 40% then the selling price for a unit in Job T687 is closest to: (Round your intermediate calculations to 2 decimal places.)

If the company marks up its unit product costs by 40% then the selling price for a unit in Job T687 is closest to: (Round your intermediate calculations to 2 decimal places.)

Definitions:

Lever

A simple machine consisting of a rigid rod or plank that pivots, or rotates, on a fixed point called the fulcrum, used to transmit or apply force.

Pellets

Small, compressed objects or particles, often used as food for pets or as ammunition in air guns.

Discrimination

Bias and discriminatory actions against persons due to their race, age, or gender.

Pigeon

A bird of the family Columbidae, known for its ability to find its way home over long distances and commonly used in research in psychology.

Q41: Neef Corporation has provided the following data

Q44: Madole Corporation has two production departments, Forming

Q48: Carriveau Corporation has two divisions: Consumer Division

Q77: A reason why absorption costing income statements

Q80: Merati Corporation has two manufacturing departments--Forming and

Q113: Variable costs per unit are not affected

Q142: Iverson Corporation's variable expenses are 60% of

Q190: Vasilopoulos Corporation has two production departments, Casting

Q200: Petty Corporation has two production departments, Milling

Q238: Which of the following would not affect