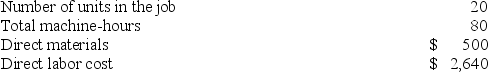

Levron Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on total fixed manufacturing overhead cost of $58,000, variable manufacturing overhead of $2.00 per machine-hour, and 20,000 machine-hours. The company has provided the following data concerning Job P978 which was recently completed:  The unit product cost for Job P978 is closest to: (Round your intermediate calculations to 2 decimal places.)

The unit product cost for Job P978 is closest to: (Round your intermediate calculations to 2 decimal places.)

Definitions:

Allowance Method

An accounting technique that estimates and records bad debts expense from credit sales based on anticipated losses.

Sales Discounts

Reductions in the price of goods or services offered to customers, usually as an incentive to encourage prompt payment.

Sales Returns

Goods returned by the customer to the seller for a refund or credit, often due to defects or dissatisfaction.

Gross Price

Gross price refers to the total price of a product or service before any deductions, such as discounts or taxes, are applied.

Q9: Smidt Corporation has provided the following data

Q27: Hadley Corporation, which has only one product,

Q58: Ashe Corporation has two manufacturing departments--Machining and

Q61: Bernson Corporation is using a predetermined overhead

Q79: Houpe Corporation produces and sells a single

Q167: Carlton Corporation has two divisions: Delta and

Q179: Data concerning Follick Corporation's single product appear

Q182: Smidt Corporation has provided the following data

Q209: Two companies with the same margin of

Q235: As the level of activity increases, how