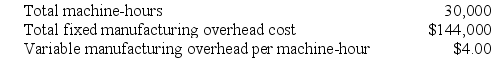

Linnear Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on the following data:

Required:

Required:

Calculate the estimated total manufacturing overhead for the year.

Definitions:

Dividends

Distributions of a portion of a company's earnings, decided by the board of directors, to a class of its shareholders, typically in the form of cash, stocks, or other assets.

Accrued Interest

Interest that has been earned but not yet received in cash or recorded, representing a liability for the payer and an asset for the receiver.

Semiannual Interest

Interest calculated and disbursed semi-annually.

Bonds

Fixed income investments representing loans made by an investor to a borrower, typically corporate or governmental, which are expected to be paid back with interest.

Q5: Baraban Corporation has provided the following data

Q9: Smidt Corporation has provided the following data

Q34: A manufacturer of cedar shingles has supplied

Q47: Uchimura Corporation has two divisions: the AFE

Q73: Sjostrom Corporation has provided the following contribution

Q87: Conversion cost is the same thing as

Q152: Mechem Corporation produces and sells a single

Q161: Eisentrout Corporation has two production departments, Machining

Q238: Conversion cost is the sum of direct

Q240: Sivret Corporation uses a job-order costing system