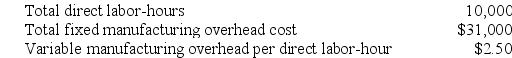

Florek Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on the following data:

Required:

Required:

a. Calculate the estimated total manufacturing overhead for the year.

b. Calculate the predetermined overhead rate for the year.

Definitions:

General Obligation Bonds

Bonds issued by municipalities that are backed by the full faith and credit of the issuing government, promising to repay the debt with general revenue.

Revenue Bond

A type of municipal bond supported by the revenue from a specific project, such as a toll bridge or highway.

State Income Taxes

Taxes imposed on income by individual states, varying in rates and structures, applicable to income earned by residents and, in some cases, non-residents working in the state.

U.S. Treasury Bonds

Long-term government debt securities issued by the U.S. Department of the Treasury with a maturity of more than ten years, offering periodic interest payments to investors.

Q10: An employee time ticket is an hour-by-hour

Q18: Abburi Company's manufacturing overhead is 60% of

Q31: The July contribution format income statement of

Q45: Sales at East Corporation declined from $100,000

Q62: Although the traditional format income statement is

Q73: Janos Corporation, which has only one product,

Q87: Macnamara Corporation has two manufacturing departments--Casting and

Q126: Nielsen Corporation has two manufacturing departments--Machining and

Q135: Rotonga Manufacturing Company leases a vehicle to

Q251: Bolander Corporation uses a job-order costing system