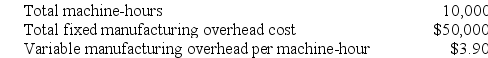

Thrall Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on the following data:

Recently Job K125 was completed and required 160 machine-hours.

Recently Job K125 was completed and required 160 machine-hours.

Required:

Calculate the amount of overhead applied to Job K125.

Definitions:

Sunk Cost

A cost that has already been incurred and cannot be removed and therefore should not be considered in an investment decision.

Straight-Line Depreciation

A method of allocating an asset's cost evenly over its useful life, resulting in a consistent depreciation expense each year.

Operating Costs

Expenses associated with the day-to-day functions of a business, excluding costs related to production or acquisition of goods.

Rate of Return

The percentage gain or loss on an investment over a specified time period.

Q2: Claybrooks Corporation has two manufacturing departments--Casting and

Q57: Aaron Corporation, which has only one product,

Q59: Kostelnik Corporation uses a job-order costing system

Q103: Gamma Corporation has sales of $120,000, a

Q166: Halbur Corporation has two manufacturing departments--Machining and

Q190: Vasilopoulos Corporation has two production departments, Casting

Q240: Nuzum Corporation has two divisions: Division M

Q244: Perkey Corporation has provided the following information:

Q272: Prather Corporation uses a job-order costing system

Q277: Clemeson Corporation, which has only one product,