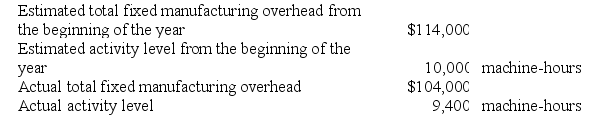

Trevigne Corporation uses a predetermined overhead rate base on machine-hours that it recalculates at the beginning of each year. The company has provided the following data for the most recent year.

Required:

Required:

Determine the amount of manufacturing overhead that would have been applied to all jobs during the period.

Definitions:

CCA Class

refers to the categorization of depreciable properties under the Capital Cost Allowance system for tax purposes in Canada, which determines the rate of depreciation.

Net Income

The final amount a company earns after taking out all costs and taxes from its revenue.

Equivalent Annual Cost

Equivalent Annual Cost is a financial analysis tool used to compare the cost efficiency of two or more investment options by transforming their costs into an annualized format.

Operating Cost

Expenses associated with the day-to-day functions of a business or organization, excluding costs related to production or acquisition of goods.

Q25: Knezevich Corporation makes a product that sells

Q44: Madole Corporation has two production departments, Forming

Q93: Mossfeet Shoe Corporation is a single product

Q148: Jerrel Corporation sells a product for $230

Q152: Mechem Corporation produces and sells a single

Q215: Kern Corporation produces a single product. Selected

Q217: Vanliere Corporation has two production departments, Machining

Q230: Kalp Corporation has two production departments, Machining

Q237: Morataya Corporation has two manufacturing departments--Machining and

Q253: Glew Corporation has provided the following information: