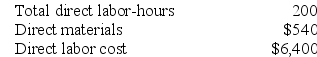

Obermeyer Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on 10,000 direct labor-hours, total fixed manufacturing overhead cost of $96,000, and a variable manufacturing overhead rate of $3.60 per direct labor-hour. Job A735, which was for 40 units of a custom product, was recently completed. The job cost sheet for the job contained the following data:

Required:

Required:

a. Calculate the amount of overhead applied to Job A735.

b. Calculate the total job cost for Job A735.

c. Calculate the unit product cost for Job A735.

Definitions:

Lost Job

The experience of being terminated or laid off from one's employment, which can have significant financial and emotional impacts.

Work-retraining Program

Programs designed to teach individuals new skills or update their existing skills to enhance their employability in the current job market.

Type A Personality

A temperament characterized by competitiveness, high ambition, aggressiveness, impatience, and a fast pace of life.

Coping

Methods or strategies used by individuals to deal with stress, manage emotions, and navigate difficult situations.

Q72: Derst Inc. sells a particular textbook for

Q96: Steffen Corporation has three products with the

Q98: Sivret Corporation uses a job-order costing system

Q106: Kreuzer Corporation is using a predetermined overhead

Q151: Levron Corporation uses a job-order costing system

Q188: Houpe Corporation produces and sells a single

Q258: Norenberg Corporation manufactures a single product. The

Q284: Bolander Corporation uses a job-order costing system

Q287: Miller Corporation produces a single product. The

Q288: The costs attached to products that have