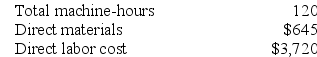

Saxon Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on 10,000 machine-hours, total fixed manufacturing overhead cost of $91,000, and a variable manufacturing overhead rate of $2.40 per machine-hour. Job K373, which was for 60 units of a custom product, was recently completed. The job cost sheet for the job contained the following data:

Required:

Required:

a. Calculate the estimated total manufacturing overhead for the year.

b. Calculate the predetermined overhead rate for the year.

c. Calculate the amount of overhead applied to Job K373.

d. Calculate the total job cost for Job K373.

e. Calculate the unit product cost for Job K373.

Definitions:

Q28: Actual overhead costs are not assigned to

Q135: Keyser Corporation, which has only one product,

Q144: The Silver Corporation uses a predetermined overhead

Q151: Levron Corporation uses a job-order costing system

Q166: Halbur Corporation has two manufacturing departments--Machining and

Q167: Carlton Corporation has two divisions: Delta and

Q194: Kubes Corporation uses a job-order costing system

Q207: Macy Corporation's relevant range of activity is

Q256: Data concerning Lemelin Corporation's single product appear

Q270: In account analysis, an account is classified