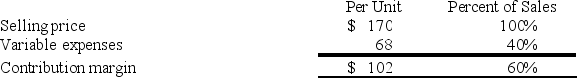

Chovanec Corporation produces and sells a single product. Data concerning that product appear below:  Fixed expenses are $521,000 per month. The company is currently selling 7,000 units per month. Management is considering using a new component that would increase the unit variable cost by $6. Since the new component would increase the features of the company's product, the marketing manager predicts that monthly sales would increase by 500 units. What should be the overall effect on the company's monthly net operating income of this change?

Fixed expenses are $521,000 per month. The company is currently selling 7,000 units per month. Management is considering using a new component that would increase the unit variable cost by $6. Since the new component would increase the features of the company's product, the marketing manager predicts that monthly sales would increase by 500 units. What should be the overall effect on the company's monthly net operating income of this change?

Definitions:

Absorption Costing

The accounting methodology that integrates all costs related to manufacturing, including direct materials, direct labor, and both forms of manufacturing overhead—variable and fixed—into a product's total cost.

Variable Costing

A financial tracking method that considers just the variable operating costs (direct materials, direct labor, and variable manufacturing overhead) in the pricing of merchandise.

Unit Product Cost

The overall expense incurred to manufacture a single item, encompassing direct materials, direct labor, and overhead costs.

Absorption Costing

Absorption costing is an accounting method that includes all of the manufacturing costs (direct materials, direct labor, and overhead) in the cost of a product.

Q59: Kostelnik Corporation uses a job-order costing system

Q104: Wenstrom Corporation produces and sells a single

Q104: Indirect costs, such as manufacturing overhead, are

Q156: Lofft Corporation has provided the following contribution

Q157: Beans Corporation uses a job-order costing system

Q164: Heroux Corporation has two manufacturing departments--Forming and

Q189: Eisentrout Corporation has two production departments, Machining

Q232: Hamernik, Inc., produces and sells a single

Q271: At an activity level of 7,200 machine-hours

Q272: Salomon Marketing, Inc., a merchandising company, reported