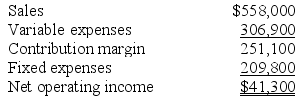

Mcquage Corporation has provided its contribution format income statement for July.

Required:

Required:

a. Compute the degree of operating leverage to two decimal places.

b. Using the degree of operating leverage, estimate the percentage change in net operating income that should result from a 19% increase in sales.

Definitions:

Implicit Marginal Tax Rate

The effective additional tax rate imposed on an individual or entity's incremental income, typically factoring in deductions, exemptions, and benefits phase-outs.

Government Benefits

Entail various forms of financial aid and services provided by the government to individuals and organizations, such as healthcare, education, and social security.

Tax Rate

The tax rate is the percentage at which an individual or corporation is taxed by the government on income, transactions, or property.

Implicit Marginal Tax Rate

Represents the rate at which an increase in income results in an increase in taxes plus the loss of government benefits, even if there's no explicit change in the tax bracket.

Q39: Germano Products, Inc., has a Pump Division

Q45: Sales at East Corporation declined from $100,000

Q47: Malakan Corporation has two production departments, Machining

Q63: Ganus Products, Inc., has a Relay Division

Q208: Spang Corporation uses a job-order costing system

Q215: Sonneborn Corporation has two manufacturing departments--Molding and

Q230: Sebree Corporation has provided the following contribution

Q259: Cost behavior is considered curvilinear whenever a

Q265: Fatzinger Corporation has two production departments, Milling

Q292: Atteberry Corporation has two manufacturing departments--Machining and