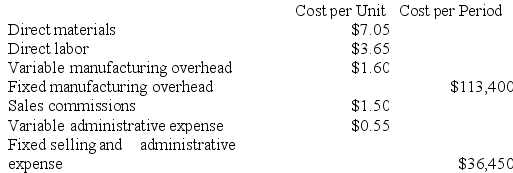

Dobosh Corporation has provided the following information:

Required:

Required:

a. For financial reporting purposes, what is the total amount of product costs incurred to make 9,000 units?

b. For financial reporting purposes, what is the total amount of period costs incurred to sell 9,000 units?

c. If 10,000 units are sold, what is the variable cost per unit sold?

d. If 10,000 units are sold, what is the total amount of variable costs related to the units sold?

e. If 10,000 units are produced, what is the total amount of manufacturing overhead cost incurred?

f. If the selling price is $21.60 per unit, what is the contribution margin per unit sold?

g. If 8,000 units are produced, what is the total amount of direct manufacturing cost incurred?

h. If 8,000 units are produced, what is the total amount of indirect manufacturing costs incurred?

i. What incremental manufacturing cost will the company incur if it increases production from 9,000 to 9,001 units?

Definitions:

Q16: Frisch Corporation produces and sells a single

Q24: Hykes Corporation's manufacturing overhead includes $4.40 per

Q33: Dietrick Corporation produces and sells two products.

Q74: Standard Corporation has developed standard manufacturing overhead

Q100: Zaccaria Corporation has provided the following contribution

Q102: Oberley Products, Inc., has a Receiver Division

Q140: Mullennex Corporation's relevant range of activity is

Q156: Ronda Manufacturing Corporation uses a standard cost

Q199: A company that makes organic fertilizer has

Q205: Vignana Corporation manufactures and sells hand-painted clay