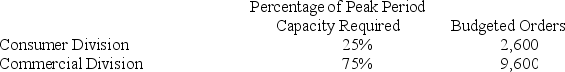

Schabel Corporation has two operating divisions--a Consumer Division and a Commercial Division. The company's Customer Service Department provides services to both divisions. The variable costs of the Customer Service Department are budgeted at $72 per order. The Customer Service Department's fixed costs are budgeted at $695,400 for the year. The fixed costs of the Customer Service Department are determined based on the peak period orders.  At the end of the year, actual Customer Service Department variable costs totaled $891,089 and fixed costs totaled $709,820. The Consumer Division had a total of 2,610 orders and the Commercial Division had a total of 9,580 orders for the year. For performance evaluation purposes, how much actual Customer Service Department cost should NOT be charged to the operating divisions at the end of the year?

At the end of the year, actual Customer Service Department variable costs totaled $891,089 and fixed costs totaled $709,820. The Consumer Division had a total of 2,610 orders and the Commercial Division had a total of 9,580 orders for the year. For performance evaluation purposes, how much actual Customer Service Department cost should NOT be charged to the operating divisions at the end of the year?

Definitions:

Form 6198

An IRS form used by taxpayers to determine the amount of at-risk activities loss that is deductible for the tax year.

At-Risk Amounts

At-Risk Amounts refer to the amount of money an individual could lose in an investment or venture, indicating the level of risk involved in the investment.

At-Risk Amount

The maximum amount of money or other assets that a taxpayer can claim as a deduction or loss from an activity, to the extent of the actual economic risk.

Material Participation Activities

Activities in which taxpayers are involved on a regular, continuous, and substantial basis in business operations.

Q9: Wollan Corporation has two operating divisions--an East

Q15: Prime cost equals manufacturing overhead cost.

Q30: Ghia Manufacturing Corporation charges its Maintenance Department's

Q30: Hawver Corporation produces and sells a single

Q41: Ghia Manufacturing Corporation charges its Maintenance Department's

Q50: Wetherald Products, Inc., has a Pump Division

Q214: Sunnripe Corporation manufactures and sells two types

Q215: A cement manufacturer has supplied the following

Q266: The cost of electricity for running production

Q270: In account analysis, an account is classified