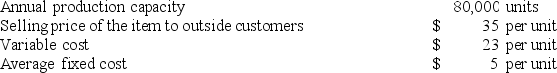

Division P of the Nyers Company makes a part that can either be sold to outside customers or transferred internally to Division Q for further processing. Annual data relating to this part are as follows:  Division Q of the Nyers Company requires 15,000 units per year and is currently paying an outside supplier $33 per unit. Consider each part below independently.

Division Q of the Nyers Company requires 15,000 units per year and is currently paying an outside supplier $33 per unit. Consider each part below independently.

If outside customers demand 80,000 units and if, by selling to Division Q, Division P could avoid $4 per unit in variable selling expense, then according to the formula in the text, what is the lowest acceptable transfer price from the viewpoint of the selling division?

Definitions:

Trial Balance Columns

Sections in a trial balance where debit and credit account balances are listed side by side to ensure they are equal.

Adjusted Trial Balance Columns

This refers to the columns in a trial balance that have been adjusted for entries made in the general journal at the end of an accounting period before the preparation of financial statements.

Net Income

The total profit of a company after all expenses, taxes, and costs have been subtracted from total revenue; also known as the bottom line.

Income Statement Credit Column

The section of the income statement where credit entries, typically revenues and gains, are recorded.

Q7: A direct cost is a cost that

Q18: The medical services department of Fischer Company

Q18: Data concerning Lemelin Corporation's single product appear

Q92: Target costing is primarily used with well-established

Q106: Holl Corporation has provided the following data

Q141: Bowering Corporation has provided the following information:

Q150: A partial listing of costs incurred during

Q152: Mcgreal Incorporated has provided the following data

Q233: At a sales volume of 20,000 units,

Q249: The following costs were incurred in May: