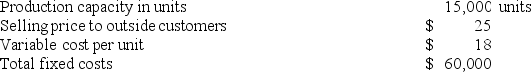

Division A makes a part with the following characteristics:  Division B, another division of the same company, would like to purchase 5,000 units of the part each period from Division A. Division B is now purchasing these parts from an outside supplier at a price of $24 each.

Division B, another division of the same company, would like to purchase 5,000 units of the part each period from Division A. Division B is now purchasing these parts from an outside supplier at a price of $24 each.

Suppose that Division A is operating at capacity and can sell all of its output to outside customers at its usual selling price. If Division A agrees to sell the parts to Division B at $24 per unit, the company as a whole will be:

Definitions:

Married Filing Jointly

A tax filing status for married couples that allows them to combine their tax obligations into a single return.

Tax Equation

A mathematical formula used to calculate the amount of taxes owed based on income, deductions, and applicable tax rates.

Net Pay

The amount of money a worker takes home after all deductions, such as taxes and retirement contributions, have been subtracted from the gross salary.

Social Security Tax

The amount of Social Security a worker pays depends on the Social Security percentage and the maximum taxable income for that year; the amount is split between the employee and the employer.

Q13: Schwiesow Corporation has provided the following information:

Q35: Schweinsberg Corporation is considering a capital budgeting

Q43: Paletta Corporation has provided the following information

Q63: Management of Plascencia Corporation is considering whether

Q70: In value-based pricing, the value of what

Q122: A step-variable cost is a cost that

Q142: The following cost data pertain to the

Q143: A product's economic value to the customer

Q175: At a sales volume of 20,000 units,

Q295: Schwiesow Corporation has provided the following information: